- Home

- About fostering

- Foster carer pay and allowances

If you’re thinking about fostering, it can sometimes feel uncomfortable asking about money, but it’s absolutely fine to speak with us about this. You need to know if fostering will work for you financially and so do we.

Whatever your background, we’re looking for the right people to help children move on to a brighter future. We pay our highly valued foster carers a generous and competitive package to recognise the good they do and so the right people can afford to foster.

The fee and allowance

Foster carers’ pay has two parts, the fee for the foster carer and the child’s allowance. You will receive a weekly fee plus the child’s allowance when they are living with you. These are paid fortnightly directly into your bank account.

The fee is basically your income as a foster carer. At Brighter Futures for Children’s IFA, we have three different fee levels (1-3), based on the knowledge, skills, experience and training of a foster carer. If you are a Level 3 foster carer, you will receive a weekly fee of up to £433.97 or up to £22,566.44 per year, most of which is tax free. You will receive the fee when you have a child in your care.

If you look after more than one child, you’ll receive an additional fee. We are working hard to find foster carers who have the space in their home and life to take on siblings. We are determined to keep brothers and sisters together and we can reward foster carers who can do this with an additional fee. If you look after more than one child, you will receive an additional 50% fee for the second and another 50% for the third child. This means if you look after three children, you will effectively be receiving two full fee payments.

We proactively support foster carers to progress through these fee levels, if you want to. Foster carers bringing relevant transferrable experience, especially previous fostering experience, start at a fee level which reflects this.

You will receive a two-week break for 14 days pro-rata.

When you have a child placed with you, you will also receive an allowance. The amount varies depending on how old the child is and could be from £177 to £281.49. The allowance will pay for the child’s day-to-day care, for example: food, clothing, hobbies, transport, outings and babysitting costs.

The child’s allowance is a weekly amount and is paid fortnightly, along with your fee, straight into your bank account. It does not count as income for tax purposes or any means-tested benefits and it does not have to be declared.

Employment status, tax and benefits

Foster carers are classed as self-employed. This means you will need to register with HMRC and do your own taxes. To support you with this, we offer free training as part of The Fostering Network and you can learn more about tax and national insurance here.

Foster carers can receive £10,000 in fostering income (fees) per year without having to pay tax. Foster carers also get a weekly tax relief amount for each foster child – £200 for children under 11, £250 for children aged 11 or over. So foster carers are generally exempt from paying tax on their income.

When you foster, your fostering allowance isn’t classed as income for the purpose of calculating means-tested benefits. Therefore, if you are able to claim them before fostering, it’s likely that you can continue to claim whilst you are fostering.

Means-tested benefits include income support, working tax credits, child tax credit, housing benefit, council tax reduction and universal credit.

It’s important to note, that just as your fostering income isn’t considered as income for means-tested benefit, any foster child you care for can’t be considered as a member of the household for the purpose of benefit, because you have your fostering allowance.

- Qualifying Care Relief means your fostering allowance won’t affect your entitlement to most state benefit payments.

- Fostering allowance will not affect Housing Benefit or Universal Credit. If you claim Carer’s Allowance or Disability Living Allowance (DLA) for your own child, it will not affect these either.

- Because fostering counts as self-employment, you could be entitled to Working Tax Credit and Child Tax Credit if you have children of your own.

- The only exception is Jobseeker’s Allowance (JSA), which will be affected if you are receiving fostering allowance

If you have a foster child with a disability, you can make an application for Disability Living Allowance (DLA) on their behalf.

You can learn more about benefits on the GOV.UK website.

Benefits of working with us

- Your own supervising social worker who will support you

- A foster carer buddy/mentor to help you through your first year

- Out of hours and evening support phone line

- Fortnightly support groups with our trauma-informed practitioner

- Membership to The Fostering Network, providing further support and discounts

- A MAX card, which gives money off for days out

- A £500 thank you when you refer a friend who becomes a foster carer

- Fun social events with foster families throughout the year including our annual foster carer awards evening

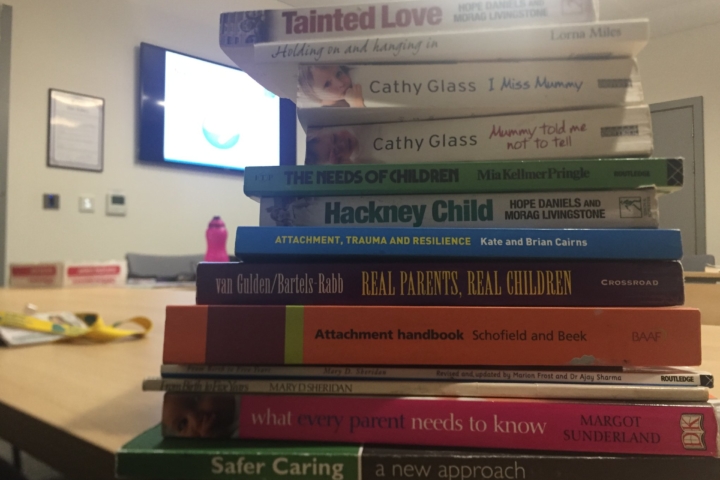

- Free excellent training opportunities

- Plus free entry to Reading Borough Council recreation and leisure facilities for all members of the fostering household

Examples of foster carer payments

- Sue is a new foster carer looking after a 15-year-old boy, Zack. She receives £339.87 per week.

- Bob and Sandra have been fostering for two years and are now fostering three siblings under the age of seven. They receive £1018.96 per week.

- Daisy and Jack are experienced carers mentoring a young 19-year-old mum and her new born baby as a parent and child placement. They receive £1089.37 per week.

Brighter Futures for Children is your primary local fostering service. We are recruiting foster carers within a 20-mile radius and joining us will be one of the most rewarding things you’ll ever do. You will be part of our community of brilliant foster carers who are committed to keeping Reading’s children in care rooted in our town, where they belong.

We are part of Brighter Futures for Children, which is independent of, by wholly owned by Reading Borough Council. This means that, as a not-for-profit IFA, we can stay focused on our priority of putting children first and can work closely with social workers and managers in Reading and with many other local services.

Still have a question about pay and allowances? Check out our FAQs or give us a call on 0118 469 3020.